| ||

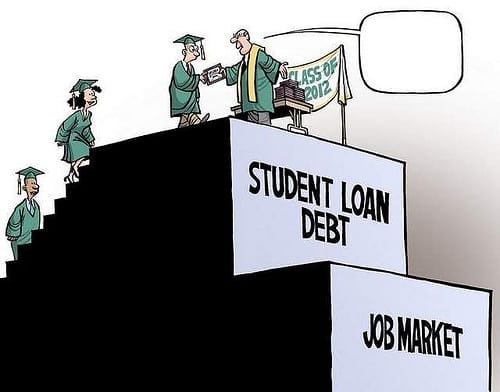

| Image source: usstudentloancenter.org - How to Defer Student Loans |

Qualifying for Loan Options

Whether or not you are in a position to acquire a deferment, forbearance, consolidation or different change in your fee standing will depend on your mortgage supplier. Federal student loan suppliers are mandated to offer you a forbearance or deferment underneath sure situations. However, the precise phrases and necessities rely upon which sort of federal student loan you maintain. You usually work with non-public lenders to barter adjustments in fee, however they aren't legally required to give you a deferment or forbearance.

Deferment Period

A deferment lets you delay student loan funds for a specified time frame. For federal loans, you will not accrue curiosity on the principal throughout a deferment. In truth, when you've got a sponsored Stafford, Direct or Perkins mortgage, the federal government may very well make curiosity funds in your behalf throughout the deferment interval. You are mechanically eligible for a federal deferral should you're enrolled at school a minimum of half-time, are unemployed, in financial hardship or within the navy. Individuals with a Perkins mortgage ought to contact their college on to request a deferment. Direct loans, FFEL loans, and personal loans ought to contact their loan supplier to request a deferment.

Forbearance Options

Individuals who do not qualify for a deferment might contemplate a forbearance. In a forbearance, you possibly can cease or scale back month-to-month funds for a time period whereas curiosity continues to accrue on the mortgage. Federal student loan suppliers should routinely grant a forbearance if the person is a member of the National Guard, in a medical or dental internship, or if the quantity you owe is greater than 20 p.c of your gross revenue. Otherwise, a forbearance is on the discretion of the lender. To request a forbearance, contact your mortgage supplier straight.

Alternative Measures

Borrowers have alternate options to deferments and forbearance. Individuals with federal loans can apply for revenue-based mostly reimbursement, which reduces month-to-month funds based mostly on present earnings degree. You additionally might be able to consolidate student loans, which lets you lengthen the period of time you must pay them. However, rates of interest on consolidated loans are sometimes larger than they're on the person loans, so chances are you'll pay extra curiosity in the long term.

No comments:

Post a Comment